maine tax rates compared to other states

Your 2021 Tax Bracket To See Whats Been Adjusted. Those are all good reasons to choose Maine as a retirement destination but what about the states tax system.

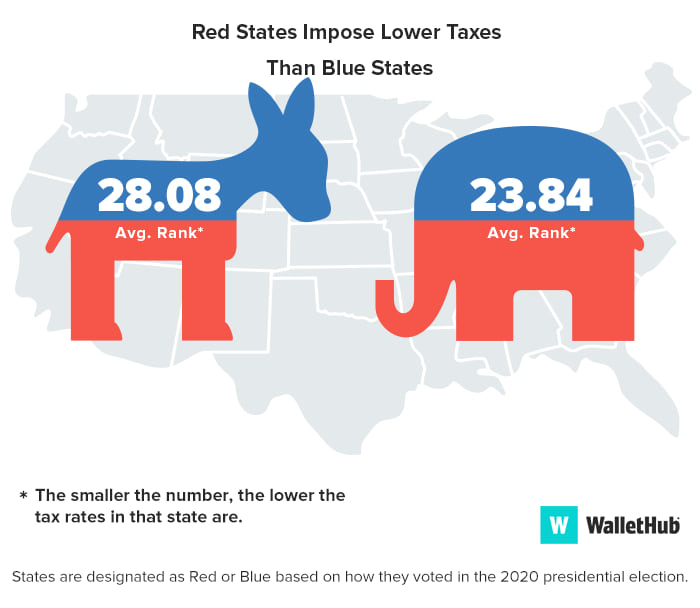

Tax Debates In U S Maine Focus On What Rich Should Pay

No state sales tax.

. One tax collection area where New Hampshire outpaces. Taxes in Maine Maine Tax Rates Collections and Burdens. California tops the list with the highest income tax rates in the countryits highest tax rate is 123 but it also implements an additional tax on those.

Other states that tax residents income might allow taxpayers to exclude a portion of. Its effective property tax rate is 247 not much higher than the 227 in Illinois. Maine Tax Rates Compared To Other States.

The Town of Scarboroughs new tax rate is now set at 1502 per 1000 of property value for the 2022 fiscal year which runs from July. State Tax Rates Comparison Property Sales Income Social Security Tax. Based on this chart New Hampshire taxpayers pay 97 of their total income to state and local taxes.

We dont make judgments or prescribe specific policies. The state ranked No. Compared with other states Maine has relatively punitive tax rules for.

State tax rates and rules for income sales gas property cigarette and other taxes that impact middle-class families. Maine Income Tax Calculator 2021. If you make 70000 a year living in the region of Maine USA you will be taxed 12188.

This means that income from capital gains can face a state rate of up to 715 in Maine. This tool compares the tax brackets for single individuals in each state. Your average tax rate is 1198 and your marginal tax rate is 22.

20 for sales and excise taxes. Maine Tax Rates Compared To Other States. Ad Compare Your 2022 Tax Bracket vs.

Maine has a graduated individual income tax with rates ranging from 580 percent to 715. Texas residents also dont pay income tax but spend 18 of their income on real estate taxes one of the highest rates in the country. Massachusetts taxpayers pay 105.

Compare these to California where. Up to 25 cash back 14. New Hampshire rounds up the list of the top three states with the highest property tax.

When filing a return you can take advantage of Maines standard. See what makes us different. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

21 in a comparison of individual income taxes and No. Pulling up stakes and moving from one state to another can. How does Maines tax code compare.

In the overall rankings other New England states ranked as follows. Vehicle Property Tax Rank Effective Income Tax Rate. Discover Helpful Information And Resources On Taxes From AARP.

Maine levies taxes on tangible personal property which includes. Use this tool to compare the state income taxes in Maine and New York or any other pair of states.

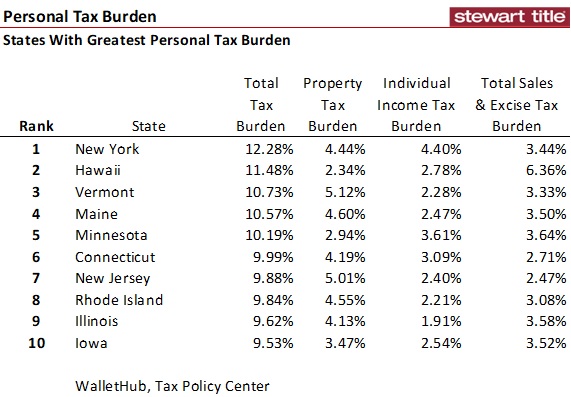

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

Here Are The Cities With The Lowest Property Taxes In Maine

What Town In Maine Has The Lowest Property Taxes Clj

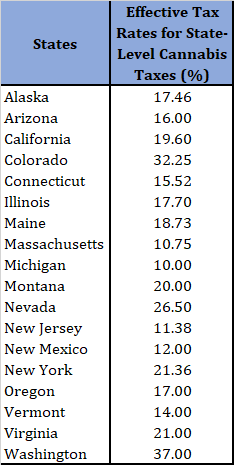

Assessing State Level Adult Use Cannabis Taxation Aaf

Report Tennessee Has Second Lowest Overall Tax Burden The Courier

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Maine State Tax Tables 2021 Us Icalculator

State By State Guide To Taxes On Retirees Kiplinger

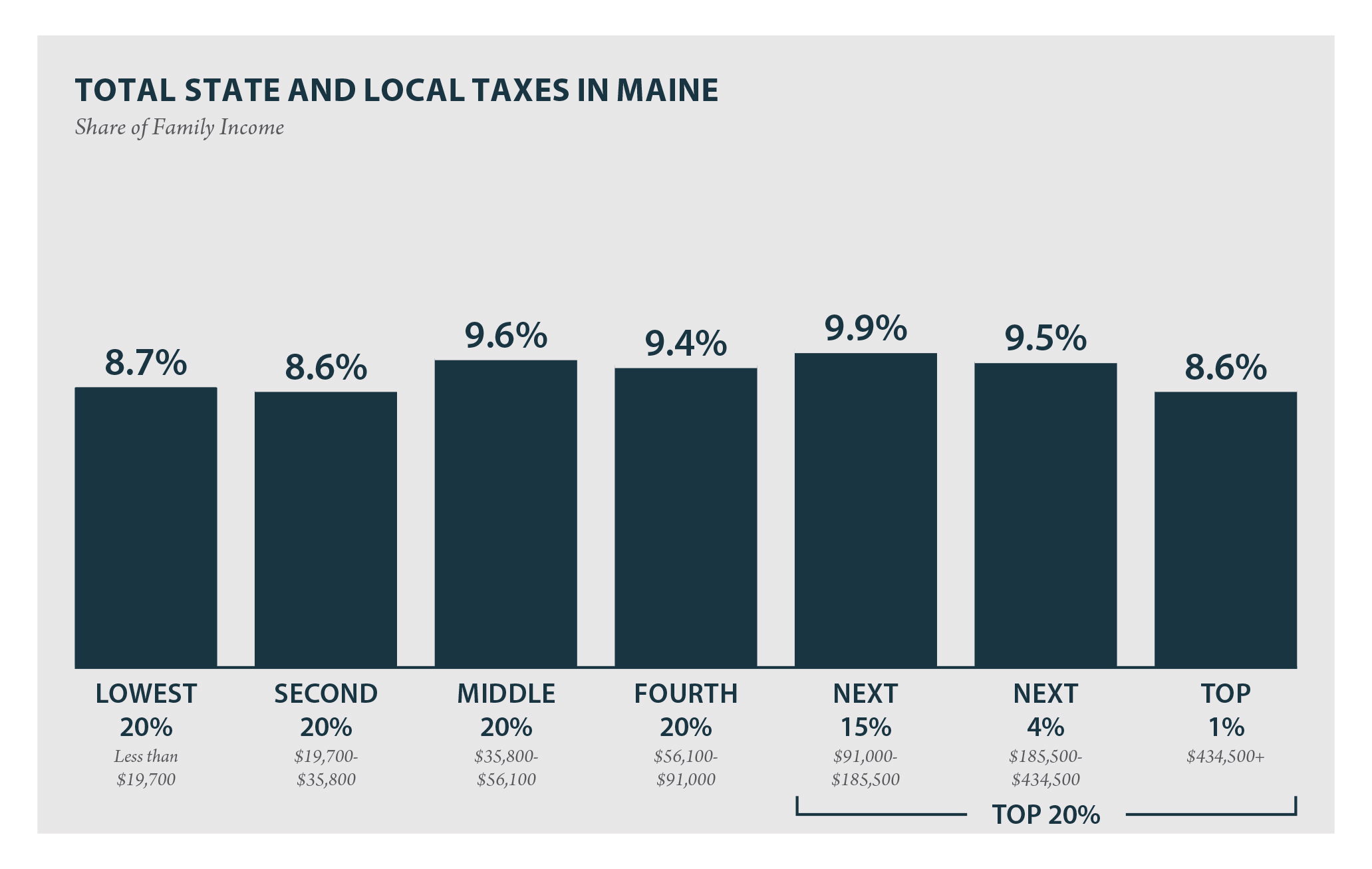

Maine Who Pays 6th Edition Itep

Publications Research Amp Commentary Taxing Alcohol Would Not Reduce Suicides Or Domestic Violence In Maine Heartland Institute

Sales Taxes In The United States Wikipedia

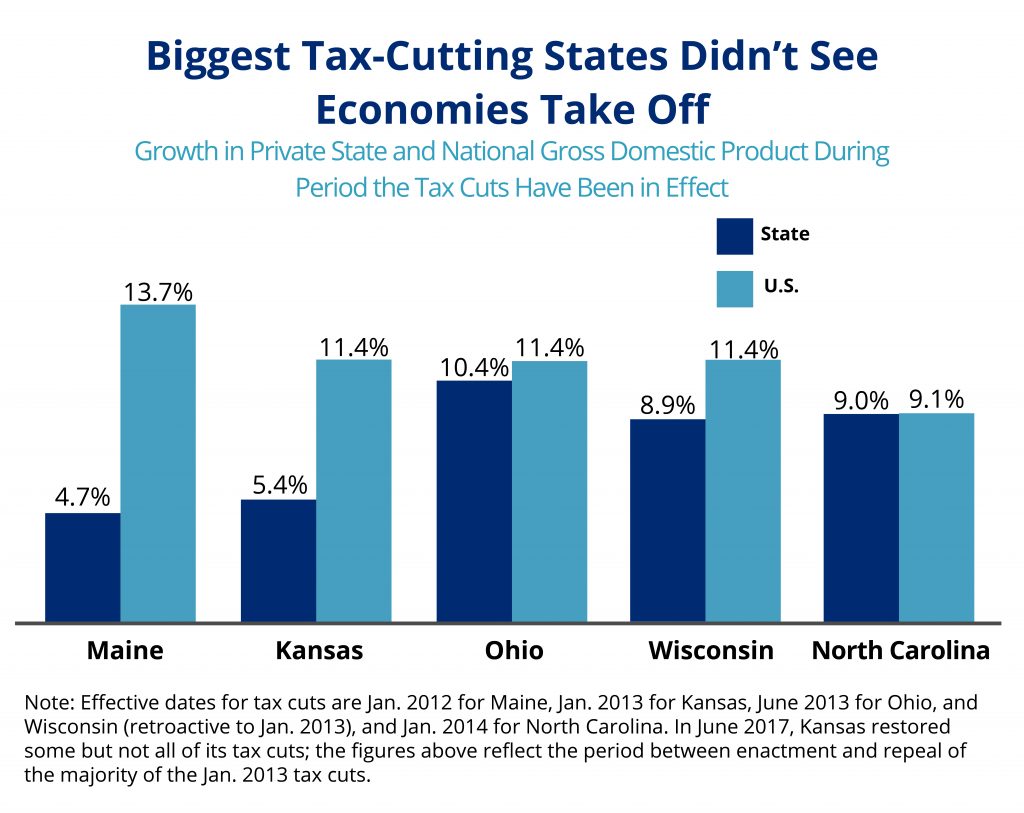

What Proposed Tax Cuts Really Mean For Montanans Montana Budget Policy Center

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

The 10 States With The Highest Tax Burden And The Lowest Zippia

The Most And Least Tax Friendly Us States

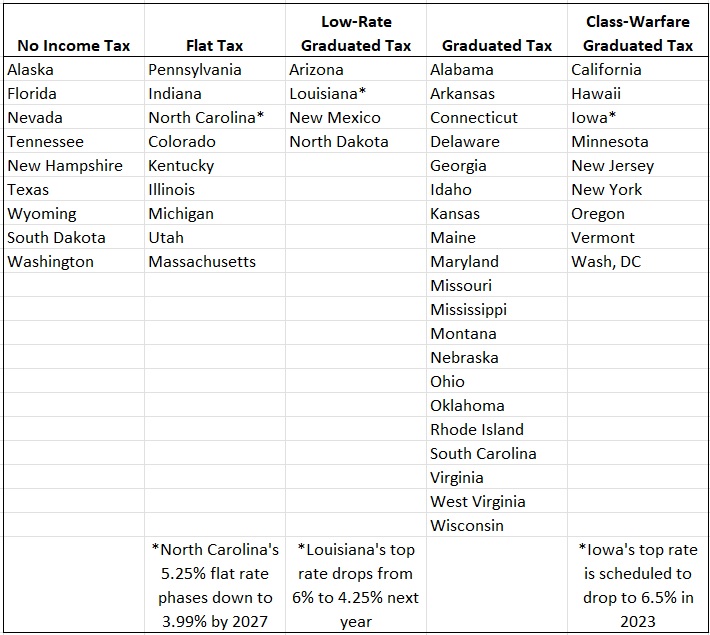

Ranking State Income Taxes International Liberty